Your Wealth Management Journey Starts Here

Financial Advising for Federal Employees in Hawaii

Our Services Support Your Financial Goals

Wealth Management

Growing, protecting and preserving wealth are all phases of a solid financial plan depending on client goals. We strive to make our holistic wealth management service enjoyable in that we provide holistic wealth management service where we lay out strategies to help accomplish goals; tend to the tedious account details; and keep an eye on trends, the market and adjust when needed.

Financial Planning

Do you need help assessing assets, debt, reducing risk and saving more for retirement? If so, creating a solid financial plan to reach your goals can make a difference in your short-term and long-term financial picture. Risk reduction is a key, yet often overlooked, component. As part of a comprehensive plan, we can address ways to potentially reduce taxes, sidestep market volatility and prepare for unknown health care costs.

Retirement Income Planning

Wondering how your assets will support you in retirement? Retirees who successfully retire and stay retired tend to have multiple income streams to pull from: investments, defined benefit pensions, 401(k) accounts, Social Security, annuities and more. We can help assess your situation and show you how your income streams can work together and offer additional strategies to increase stability.

Insurance Strategies

Reducing risk and seeking financial protection is the goal of insurance. Life insurance can provide financial resources for a spouse for family when an untimely death occurs. Long-term care insurance can provide a safety net for health care assistance and covering the associated financial costs when someone suffers from a long-term illness or disability. Annuities can provide a stable, guaranteed* income stream that can be helpful retirement.

Legacy Planning

Leaving a legacy for a spouse, family or favorite charity is an appreciated gift for those left behind. It shows you cared enough to think through the needs of loved ones and make provisions for financial resources and other assets. We can help source insurance policies and work with attorneys and estate planners to make sure wills, trusts and other legal documents are in place to support your wishes.

Federal Employee Benefits

Deciphering Federal employee benefits and pensions can be overwhelming. We have experience working with hundreds of federal employees to understand their options and provide information so they can make the best choices for their situation. If you are nearing retirement, we can also help you understand how your pension will work with other income streams in retirement to support you.

*Guaranteed lifetime income available through annuitization or the purchase of an optional lifetime income rider, a benefit for which an annual premium is charged. Annuities are long-term, tax-deferred vehicles designed for retirement and contain some limitations.

Advisory Client

At the heart of our services lies Asset Management, where we diligently invest your funds with utmost responsibility and care. Explore our premier investment models to find the one that aligns with your goals, or allow us to tailor a unique portfolio specifically for you.

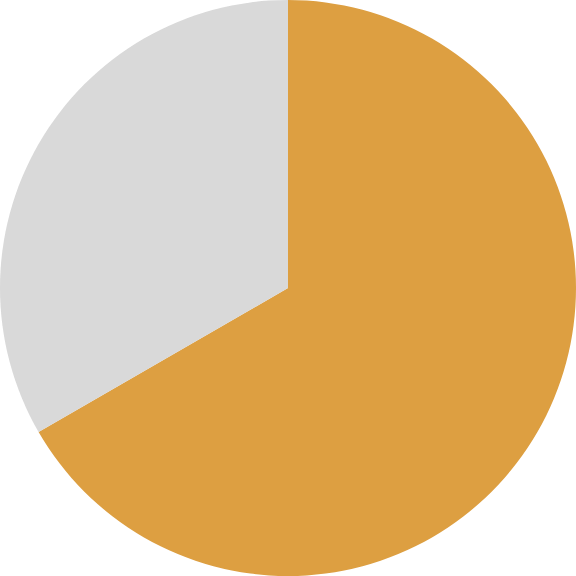

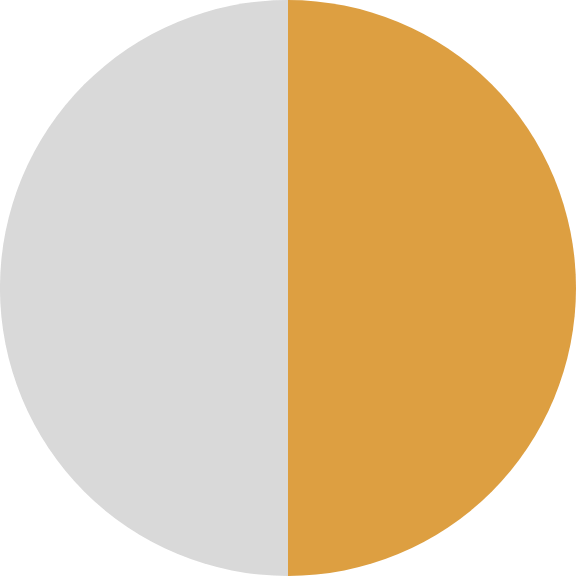

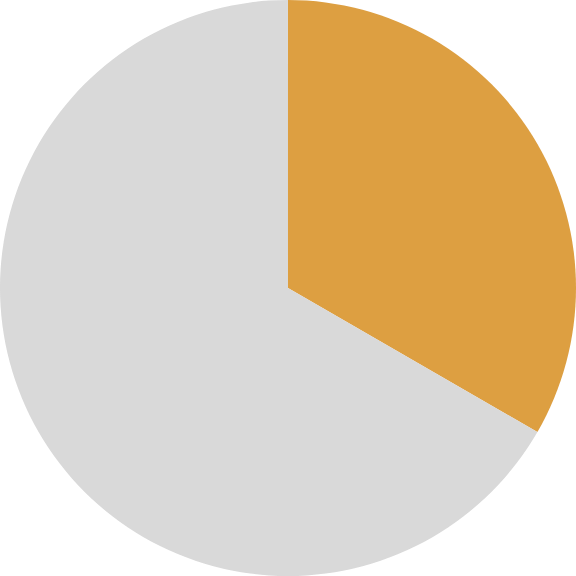

Preservation & Income

Income & Growth

Moderate

Growth

Digital Assets

Fixed Income

Equities

Asset Management

No Commissions

No Trading Fees

2 Reviews Per Year or as Needed

Our digital portfolio management process is a customized selection that can include ETFs, mutual funds, individual stocks and bonds. We can meet 1-2 times per year for portfolio review and are always a phone call away for any questions and additional support.

*AUM = Assets Under Management. Annual fee structure based solely on the assets we manage.

5 Simple Steps to a Successful Retirement

Do you have doubts about your ability to reach your retirement goals? Are you less than confident about certain aspects of your retirement strategy? Here’s the good news…there’s always time to adjust your plan and get back on track. You can take your retirement strategy from flop to blockbuster with these simple strategies.